INSURANCE PRODUCT SUMMARY

Device Protection for Apple featuring AppleCare Services

Insurer

Zurich Insurance Company Ltd (Canadian Branch)

100 King Street West, Suite 5500

P.O. Box 290

Toronto, Ontario M5X 1C9

Telephone: 1-800-387-5454

Autorité des marchés financiers Client Number: 2000698728

Distributor

Rogers Communications Canada Inc. (“Rogers”)

333 Bloor Street East

Toronto, Ontario M4W 1G9

Telephone: 1-888-ROGERS-1 (1-888-764-3771)

Autorité des marchés financiers

Place de la Cité, tour Cominar 2640 boulevard Laurier, 4e étage

Québec (Québec) G1V 5C1

Québec City: 418 525-0337

Montreal: 514 395-0337

Toll Free: 1 877-525-0337

Fax: 418 525-9512

Website: www.lautorite.qc.ca

What is the purpose of this document?

This Product Summary summarizes your insurance coverage and is intended to help you decide whether this insurance meets your needs.

This is not your insurance policy. For complete details of insurance coverages, eligibility, conditions and exclusions, please refer to your insurance policy. You can find a specimen copy of your insurance policy here: https://protect.likewize.com/mobileprotection/#Resources or https://www.zurichcanada.com/en-ca/services/product-summaries. Please read it carefully.

Who is covered?

This insurance provides coverage to customers who have bought a mobile device from Rogers.

What is covered?

Device Protection for Apple featuring AppleCare Services is a damage and loss/theft insurance product. This insurance provides certain benefits to customers of Rogers if their mobile device:

• has a mechanical or electrical breakdown;

• is lost or stolen;

• experiences direct physical loss or damage; or

• malfunctions as a result of defects in parts and workmanship, including where the capacity of an integrated rechargeable battery to hold an electrical charge is less than 80% of its original specification.

We will cover these losses wherever the mobile device is located in the world.

Summary of key conditions

Who is eligible for coverage?

You are eligible for coverage if:

• you have bought a mobile device from Rogers;

• your billing address with Rogers on the date you purchase coverage is in the Province of Quebec; and

• you purchase coverage at the time of activating your mobile device or equipment upgrade or within sixty (60) days of activating or upgrade.

You must remain an active customer of Rogers in order to continue to be entitled to coverage.

When coverage starts

Your insurance coverage begins on the date set out in the Declarations provided to you. You must complete a voice or data session that logs airtime on the network chosen when you activated your Rogers device using the mobile device in order for coverage to be effective.

When coverage ends

Your insurance coverage ends at the earliest of the date and time when:

• You cancel the coverage, or

• We cancel the coverage, or

• You cease to be a customer of Rogers.

Coverage Amounts

The following table is a summary of the maximum coverage amounts:

Occurrence limit: Subject to the Aggregate Limit of Insurance, for any approved claim, we will not pay more than the limit below corresponding to your Tier.

1The Screen Repair Deductible for iPhone models 12 and newer (excluding iPhone SE) applies individually to front screen and back glass breakage. For illustrative purposes, if the claim is for both front screen and back glass breakage repair, the deductible is $78 ($39 per repair).

2You are not required to pay a Repair Deductible for up to one claim for the repair of either front screen or back glass breakage with the following exclusions and limitations: (1) iPads are excluded; (2) back glass breakage repair applies to iPhone models 12 and newer (excluding iPhone SE), for all other models and devices, back glass damage is considered to be “All Other Damage”; and (3) there must be no other defects or evidence of loss or failure present at the time of screen repair.

3The All Other Damage Repair Deductible applies to any claim for direct physical loss or damage to the Insured Device.

4The Warranty Malfunction Deductible applies to any claim for mechanical or electrical breakdown of the Insured Device or operational or structural malfunction of the Insured Device’s ability to operate due to defects in parts or workmanship, including where the capacity of an integrated rechargeable battery to hold an electrical charge is less than 80% of its original specification.

Additional fees you may be charged are as follows:

Claim Conversion Fee

A claim conversion fee will be charged equal to the difference between either: (i) the repair deductible paid and the repair deductible due if the device has damage beyond the screen, or (ii) the repair deductible paid and the replacement deductible due if the device cannot be repaired and you elect to have it replaced.

Non-Return Fee

A non-return fee not exceeding the unsubsidized, new retail price of the Insured Device at thetime of enrollment may be charged if you do not return the device within 30 days of receipt of a replacement device.

Locked Device Fee

A locked device fee not exceeding the unsubsidized, new retail price of the Insured Device at the time of enrollment may be charged if you do not return the Insured Device to us unlocked.

How to file a claim

Your Obligations

To report a claim, you must visit www.rogers.com/servicerequest or call us at 1-855-877-3887. For a Covered Cause of Loss that involves loss or theft of the Insured Device, you must report the claim within 60 days of the loss. If your Insured Device experiences a warranty malfunction or accidental damage, you may also file a claim by visiting getsupport.apple.com or calling 1-800-263-3394.

Upon reporting a claim, we may send you a proof of loss form to fill out.

Upon our request, you must send us:

• the completed proof of loss form,

• the original bill of sale for the mobile device and a wireless billing statement or written verification by Rogers,

• in the case of theft or vandalism, a copy of the filed police report, provided that such reports are accepted by local police, and

• any other information and documents we may require. within 60 days after the date you report a claim of the loss.You will be responsible for the cost of providing such documents and information to us.

You Must Return the Mobile Device

If your mobile device is damaged, you must keep it until your claim is completed. You will be required to return the mobile device to us at our expense. If you do not return your mobile device within 30 days of receiving your replacement device, you may be charged a non-return fee. The non-return fee will not be more than the unsubsidized, new retail price of the mobile device at the time of your enrollment.

The “Find My” feature must be enabled at the time of loss in order to file a claim for loss or theft. If you recover a lost or stolen mobile device, you must return it to us at our expense. We may restrict the IMEI of the mobile device if you report it lost or stolen.

You must return your mobile device to us unlocked. If the device is locked, we may charge you a locked device fee not exceeding the unsubsidized, new retail price of the mobile device at the time of enrollment.

You Must Back-Up the Software

You must back up all software and data before sending your mobile device to us for repair or replacement.

Our Duties

Repair or Replacement

Once we approve a claim, we will arrange for the repair or replacement of your mobile device through an Authorized Service Centre. Any replacement will be a new Apple device or a certified pre-owned Apple device. We will not reimburse you for any out-of-pocket expenses. We may, in our sole discretion, pay to you the current replacement market value of the Insured Device instead of repairing or replacing the Insured Device.

We May Use Refurbished Parts

We may repair your mobile device with substitute parts, or provide you with substitute equipment, that is of like kind, quality and functionality. It may also be new, refurbished or remanufactured, and may contain original or non-original manufacturer parts; and may be a different brand, model or colour.

If Your Original Device Is Not Available

If the original make and model of your mobile device is no longer in stock, you will receive comparable equipment.

Delivery of Replacement Device

Once a claim is approved, you will receive the replacement by mail within 2-10 business days. We will ship the replacement device directly to you within Canada or you may be required to pick up your replacement at an Authorized Service Centre.

For more details regarding covered losses, please refer to Section G (Reporting and Filing a Claim) and Section H (Our Duties in Event of a Claim) in your insurance policy.

Consequences of misrepresentation and concealment

Any fraud, intentional concealment or misrepresentation of a material fact relating to this policy, the mobile device, your interest in the mobile device, or a claim may void your insurance.

If the make/model or condition of the mobile device received by the Authorized Service Centre does not match the model provided in the claim or described in your proof of loss statement, or is not damaged, you may be charged the full retail value of the replacement device (up to the maximum amount shown in the Declarations).

What is not covered?

Property Not Covered

This insurance excludes certain property from coverage. The list below summarizes the most common excluded property. Please refer to Section B (Coverage) in your policy for full details of all property excluded.

1. Data stored on or processed by the mobile device, including documents, databases, messages, licenses, contact information, passwords, books, games, magazines, photos, videos, ringtones, music, screen savers and maps; and

2. A wireless device whose unique identification number (including serial number, ESN, MEID and IMEI)has been altered or removed.

Exclusions

This insurance contains exclusions from coverage. The list below summarizes some of the most common exclusions. Please refer to Section C (Exclusions) in your policy for the complete list and full details of all exclusions.

This insurance does not apply to mechanical or electrical breakdown, loss, damage or theft directly or indirectly caused by or resulting from any of the following:

1. Delay, Loss of Use

Indirect or consequential loss or damage, including loss of use, interruption of business, loss of service, loss of market, loss of time, loss of profits, inconvenience or delay in repairing or replacing a lost or damaged mobile device.

2. Dishonest or Criminal Acts

Dishonest, fraudulent or criminal acts by you or anyone you authorize to use the mobile device or entrust with the mobile device, or anyone else with an interest in the mobile device, whether or not they are acting alone.

3. Obsolescence

Obsolescence or depreciation.

4. Recall or Design Defect

a. Manufacturer’s recall; or

b. Error or omission in design, programming or system configuration.

5. Cosmetic Damage

Cosmetic damage that does not affect the functioning of the mobile device. This includes:

a. Marring, or scratching;

b. Change in colour or other change in the exterior finish; and

c. Expansion or contraction.

6. Late Claims

Claims not reported as required by the policy.

7. Repair Work

Unauthorized repair or replacement, or preventative maintenance or alterations or improvements.

8. Virus

Computer virus whether intentional or unintentional.

9. Intentional Loss or Damage

Abuse, intentional acts or use of the mobile device in a manner inconsistent with the use for which it was designed or intended, or that would void the manufacturer’s warranty, or failure to follow the manufacturer’s installation, operation or maintenance instructions.

10. Personalized Data

Loss or damage to personalized data, or customized software, such as personal information managers (PIM’s), ringtones, games, or screen savers; or loss or damage to antennas, external housings or casings that does not affect the function of the mobile device.

11. Normal Wear and Tear

Normal wear and tear, gradual deterioration, or latent defect.

12. Fees or Charges

Any fees or charges assessed by Rogers or anyone acting on their behalf.

Privacy

You can review our privacy statement at https://www.zurichcanada.com/en-ca/about-zurich/privacy-statement

Other important information

Cost of insurance

The amount you are required to pay to purchase the insurance is as follows (plus applicable taxes):

Premiums are subject to change over time with no less than 30 days’ notice.

Cancellation

Cancellation by you

You may cancel this insurance at any time by:

• mailing or delivering an advance written notice to

Rogers Customer Care

70 Assomption Blvd.

Moncton, NB E1C 1A1

or

• contacting Rogers using the following link, https://www.rogers.com/contact stating when such cancellation is effective.

You may cancel the insurance without penalty even if more than 10 days has passed from the date you purchased the insurance, notwithstanding the “NOTICE OF RESCISSION OF AN INSURANCE CONTRACT” form which is required by law to be attached to this Product Summary.

Cancellation by Us

We may cancel this insurance by mailing, delivering or emailing to you notice of cancellation at least:

• 15 days before the effective date of cancellation if we cancel for nonpayment of premium; or

• 60 days before the effective date of cancellation if we cancel for any other reason.

Our notice will be mailed or delivered to you at the last mailing address known to us or sent electronically to you. Your coverage will end on the effective date of cancellation set out in our notice of cancellation.

If your policy is cancelled, we will refund any unearned premium to you. For example, if you cancel with 10 days left in your monthly billing period, your refund would be equal to 10 days of premium paid (which would be calculated by dividing your monthly premium by the number of days in that month, and multiplying by 10).

You Cease to be a Customer of Rogers

The insurance provided to you under this policy is provided on a month to month basis unless you cease to be an active customer of Rogers.

How to make a complaint:

To make a complaint and access the Insurer's complaint handling procedures, please visit: https://www.zurichcanada.com/en-ca/about-zurich/complaint

You may also send your complaint by a letter, e-mail or phone call using the contact information below:

Ombudsman

Zurich Insurance Company Ltd (Canadian Branch)

100 King Street West

Suite 5500

P.O. Box 290

Toronto ON M5X 1C9

Office: 416-586-6773

Toll Free: -1(800)387-5454 ext.6773

E-mail: ombudsman.zurich.canada@zurich.com

The purpose of this fact sheet is to inform you of your rights. It does not relieve the insurer or the distributor of their obligations to you.

LET'S TALK INSURANCE!

Name of distributor: Rogers Communications Canada Inc. (“Rogers”)

Name of insurer: Zurich Insurance Company Ltd (Canadian Branch)

Name of insurance product: Device Protection for Apple featuring AppleCare Services

IT'S YOUR CHOICE

You are never required to purchase insurance:

- that is offered by your distributor;

- from a person who is assigned to you; or

- to obtain a better interest rate or any other benefit.

Even if you are required to be insured, you do not have to purchase the insurance that is being offered. You can choose your insurance product and your insurer.

HOW TO CHOOSE

To choose the insurance product that's right for you, we recommend that you read the summary that describes the insurance product and that must be provided to you.

DISTRIBUTOR REMUNERATION

A portion of the amount you pay for the insurance will be paid to the distributor as remuneration. The distributor must tell you when the remuneration exceeds 30% of that amount.

RIGHT TO CANCEL

The Act allows you to rescind an insurance contract, at no cost, within 10 days after the purchase of your insurance. However, the insurer may grant you a longer period of time. After that time, fees may apply if you cancel the insurance. Ask your distributor about the period of time granted to cancel it at no cost.

If the cost of the insurance is added to the financing amount and you cancel the insurance, your monthly financing payments might not change. Instead, the refund could be used to shorten the financing period. Ask your distributor for details.

The Autorité des marchés financiers can provide you with unbiased, objective information. Visit www.lautorite.qc.ca or call the AMF at 1-877-525-0337.

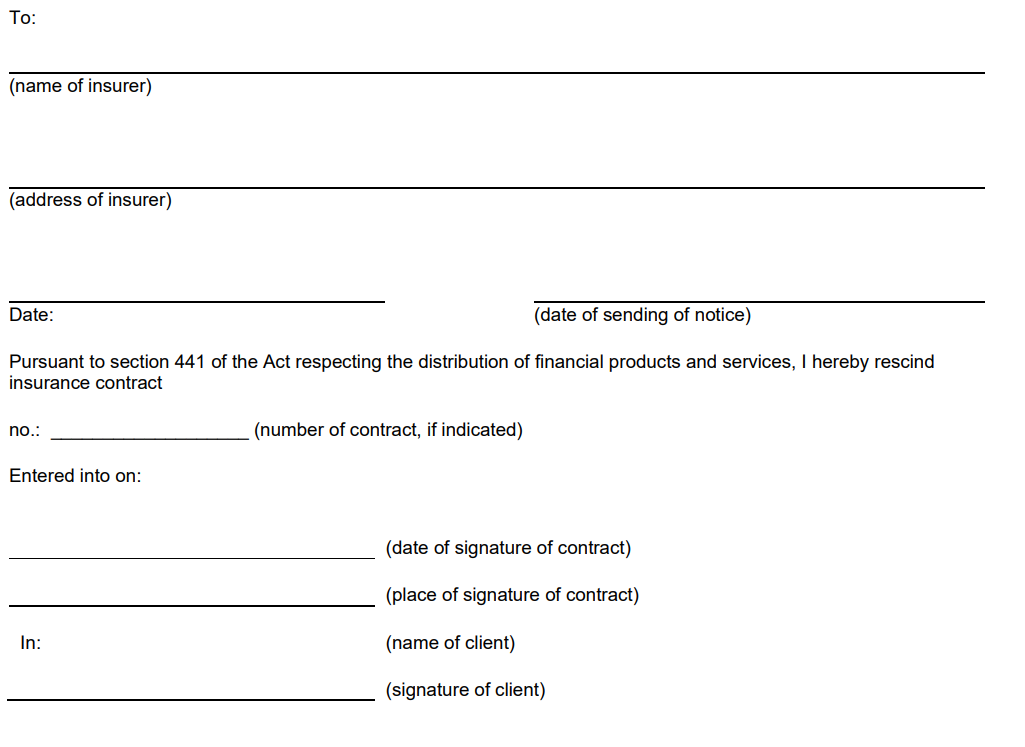

NOTICE OF RESCISSION OF AN INSURANCE CONTRACT

NOTICE GIVEN BY A DISTRIBUTOR

Section 440 of the Act respecting the distribution of financial products and services (chapter D-9.2)

THE ACT RESPECTING THE DISTRIBUTION OF FINANCIAL PRODUCTS AND SERVICES GIVES YOU IMPORTANT RIGHTS.

The Act allows you to rescind an insurance contract, without penalty, within 10 days of the date on which it is signed.

However, the insurer may grant you a longer period.

To rescind the contract, you must give the insurer notice, within that time, by registered mail or any other means that allows you to obtain an acknowledgement of receipt.

Despite the rescission of the insurance contract, the first contract entered into will remain in force. Caution, it is possible that you may lose advantageous conditions as a result of this insurance contract; contact your distributor or consult your contract.

After the expiry of the applicable time, you may rescind the insurance contract at any time; however, penalties may apply. For further information, contact the Autorité des marchés financiers at 1-877-525-0337 or visit www.lautorite.qc.ca.

NOTICE OF RESCISSION OF AN INSURANCE CONTRACT

Product Summary & Fact Sheet- Apple >